Complyia doesn’t just manage compliance— it understands your data, continuously detects issues, and shows the impact of decisions before they happen. With real-time scenario planning, you can evaluate restructurings, entity changes, and tax outcomes before committing, turning compliance data into strategic foresight.

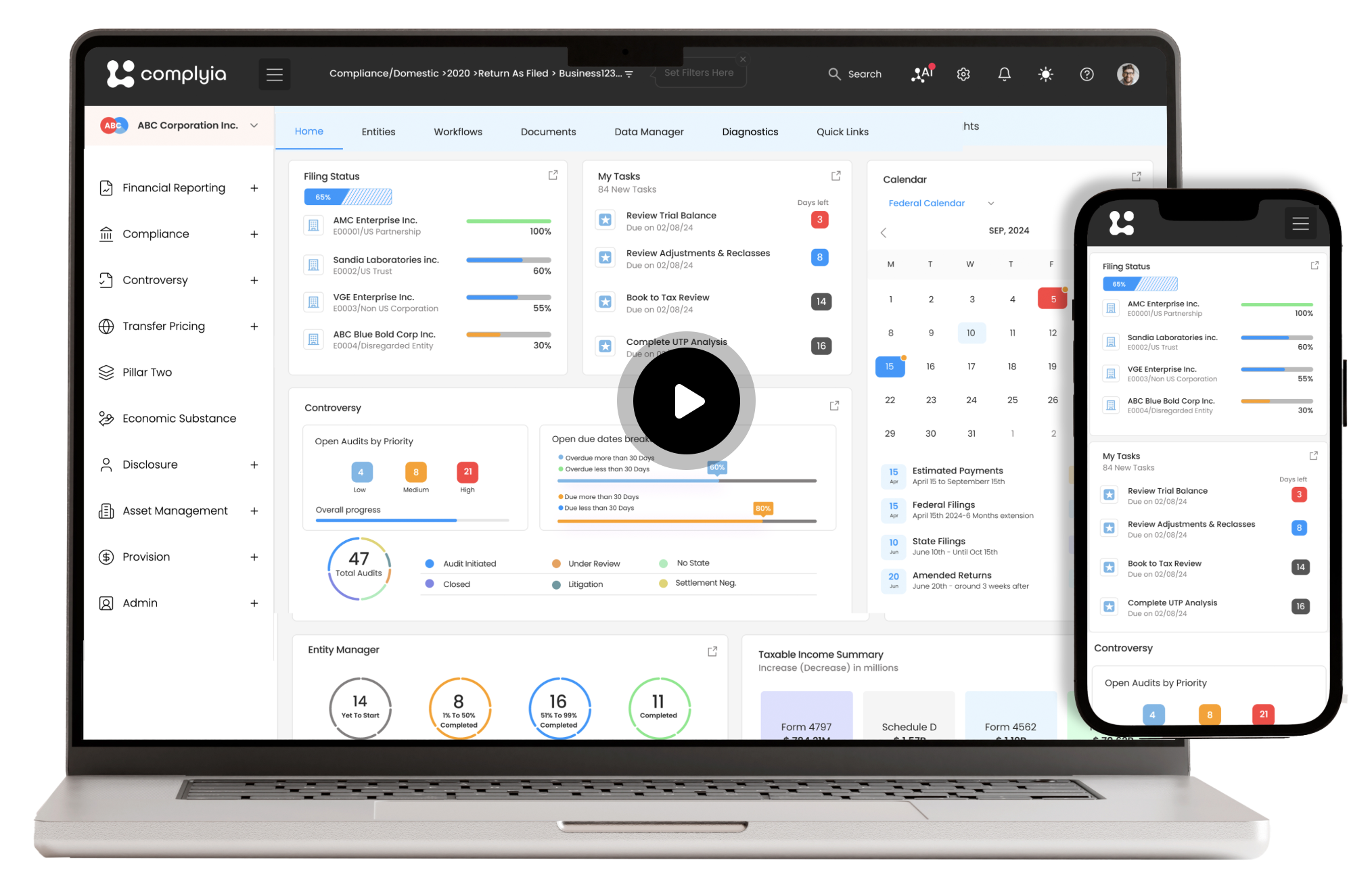

The Platform

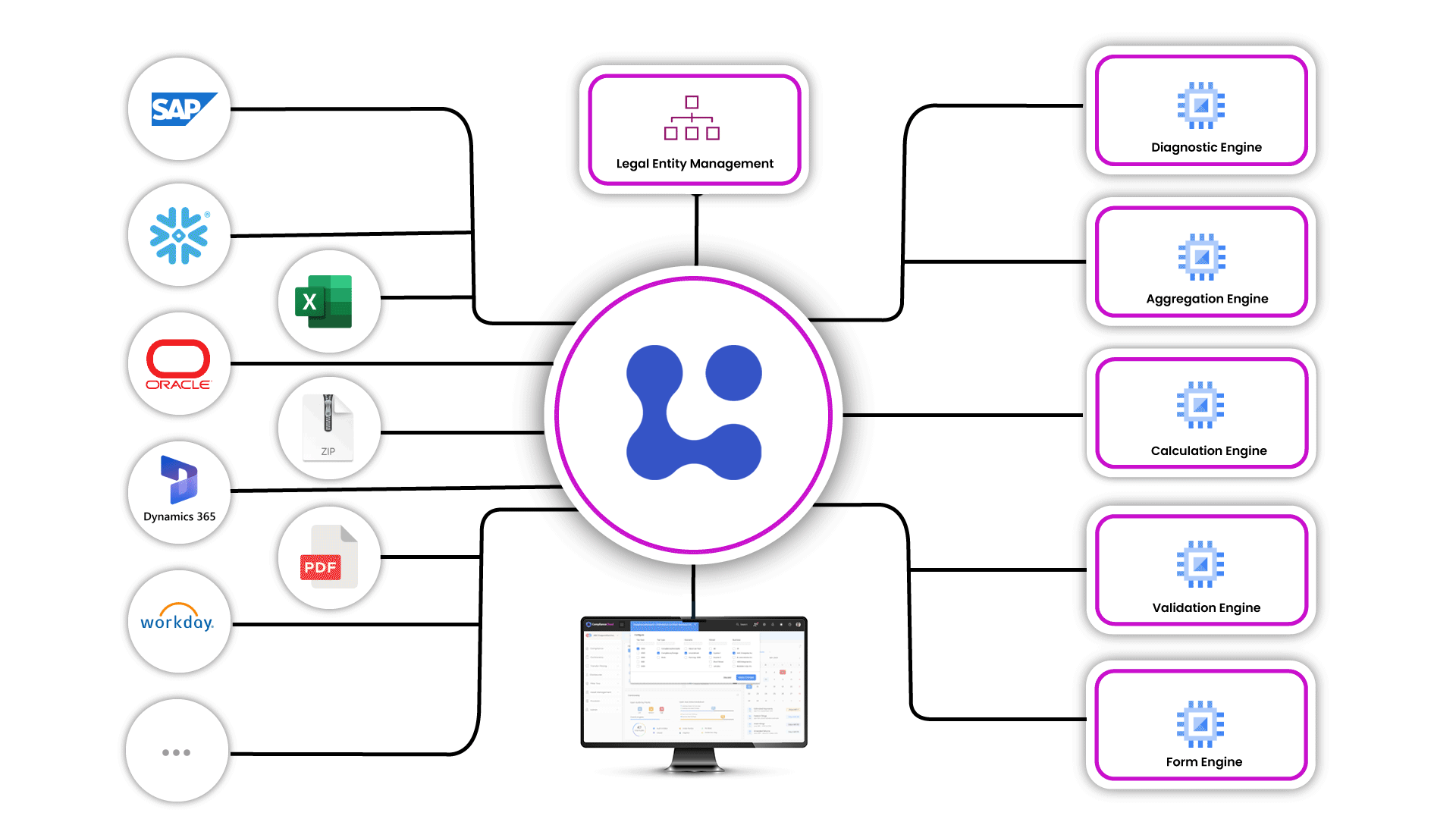

Complyia orchestrates the intelligence layer that connects, validates, and explains your financial and tax data. It connects, interprets, and validates data from ERPs (SAP, Oracle, NetSuite, Workday, etc.) and file-based sources (Excel, CSV, local systems) — unifying them into a real-time, compliance-grade intelligence layer.

By unifying data at the most granular level — with every attribute, tag, and context intact — Complyia delivers one trusted source of truth. This level of granularity preserves full data lineage and context, enabling AI to automate with precision, maintain consistency across domains, and provide real-time, audit-ready insight.

"Your ERP's record the numbers" — "Complyia explains them and automates what happens next."

Our Data Foundation

By consolidating data into a single source of truth, the platform not only ensures consistency and streamlined access but also eliminates the massive inefficiencies caused by fragmented systems—where 70% to 80% of time is often wasted on manual data wrangling. This shift not only reduces wasted effort but unlocks the full potential of AI models. Centralized data provides the foundation for more accurate and effective AI-driven insights, enabling predictive analytics, process automation, and smarter decision-making—making data centralization a critical driver of innovation and organizational success

With clean, real-time data, Complyia unlocks AI’s full potential—delivering accuracy, speed, and insights you can trust.

DATA READINESS:

AI is only as powerful as the data behind it.

Complyia’s Data Readiness framework transforms messy, fragmented data into clean, structured, and validated information ready for automation and real-time insight. With AI Column Mapping, Complyia automatically identifies, aligns, and standardizes columns across any ERP or file format—eliminating tedious manual setup. Then, AI Row Mapping intelligently connects local accounts to Complyia’s standardized system mappings, ensuring accuracy and consistency across every import. When you clean a file once, Complyia remembers—automatically applying the same logic to future uploads. Over time, it learns and adapts, removing repetitive cleanup and accelerating every workflow. With complete data lineage from import to audit, Complyia ensures every decision is built on trusted, traceable, and ready-to-use data—unlocking speed, accuracy, and confidence across finance and compliance.

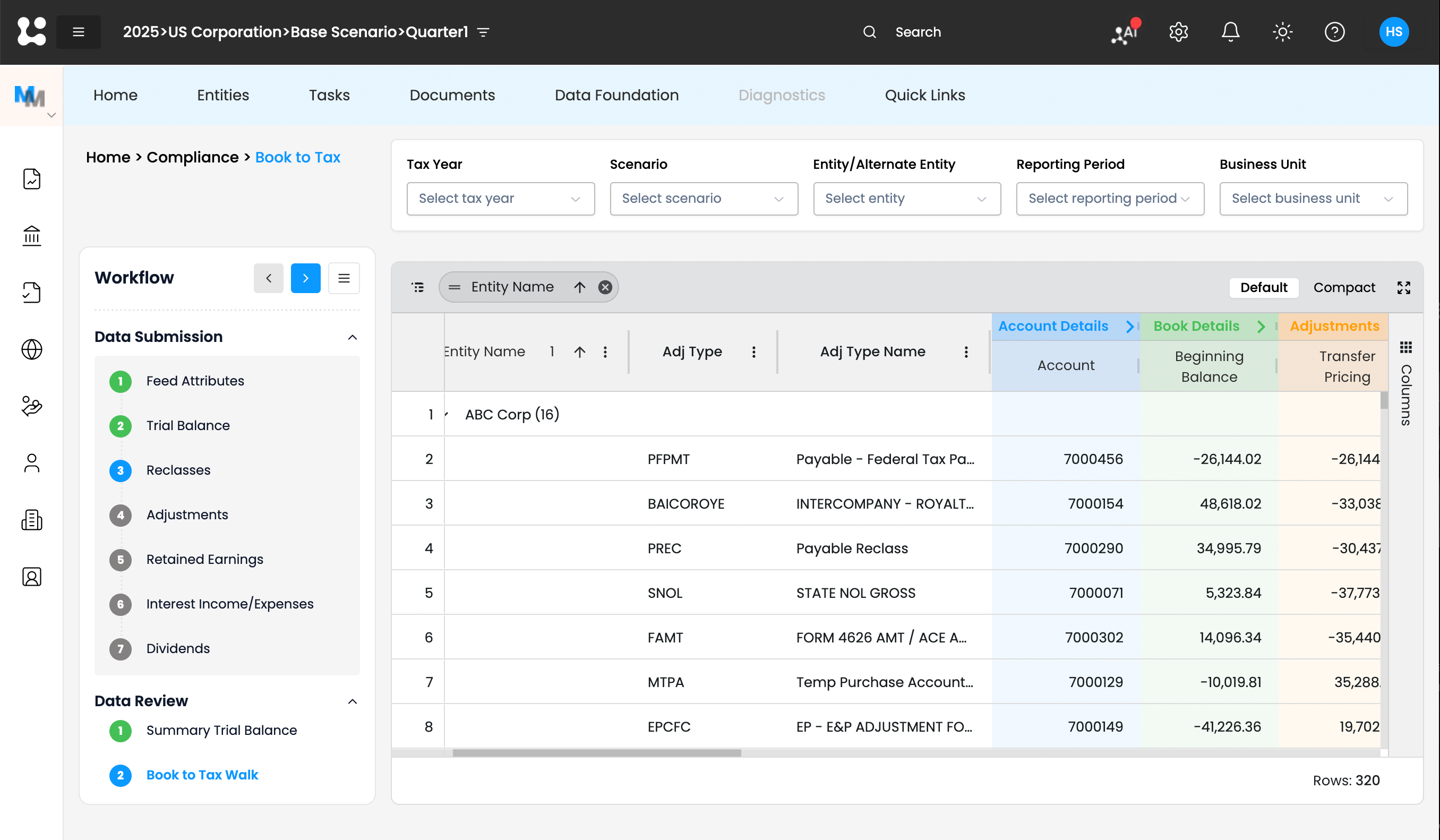

Provision: Where Everything Begins

Because provision sits at the center of your financial data, it becomes the foundation for everything that follows — powering compliance automation, planning and forecasting, scenario modeling, and audit-ready transparency.

This is where the shift happens: a real-time Book-to-Tax and a real-time Tax Basis Balance Sheet change the game. When Book-to-Tax is automated and continuously maintained:

- Adjustments aren’t re-built every quarter — they persist and evolve.

- DTAs/DTLs roll forward instantly, with clear explanations.

- The Tax Basis Balance Sheet updates the moment the books change.

- No more “chasing” numbers across spreadsheets and emails.

Provision isn’t the end of the process — it is the foundation.

With Complyia, it becomes real-time, explainable, connected, and strategic.

Complyia’s AI engine transforms provision into a live feedback loop—continuously interpreting book changes and fueling compliance automation, scenario planning, and strategic decisions in real time.

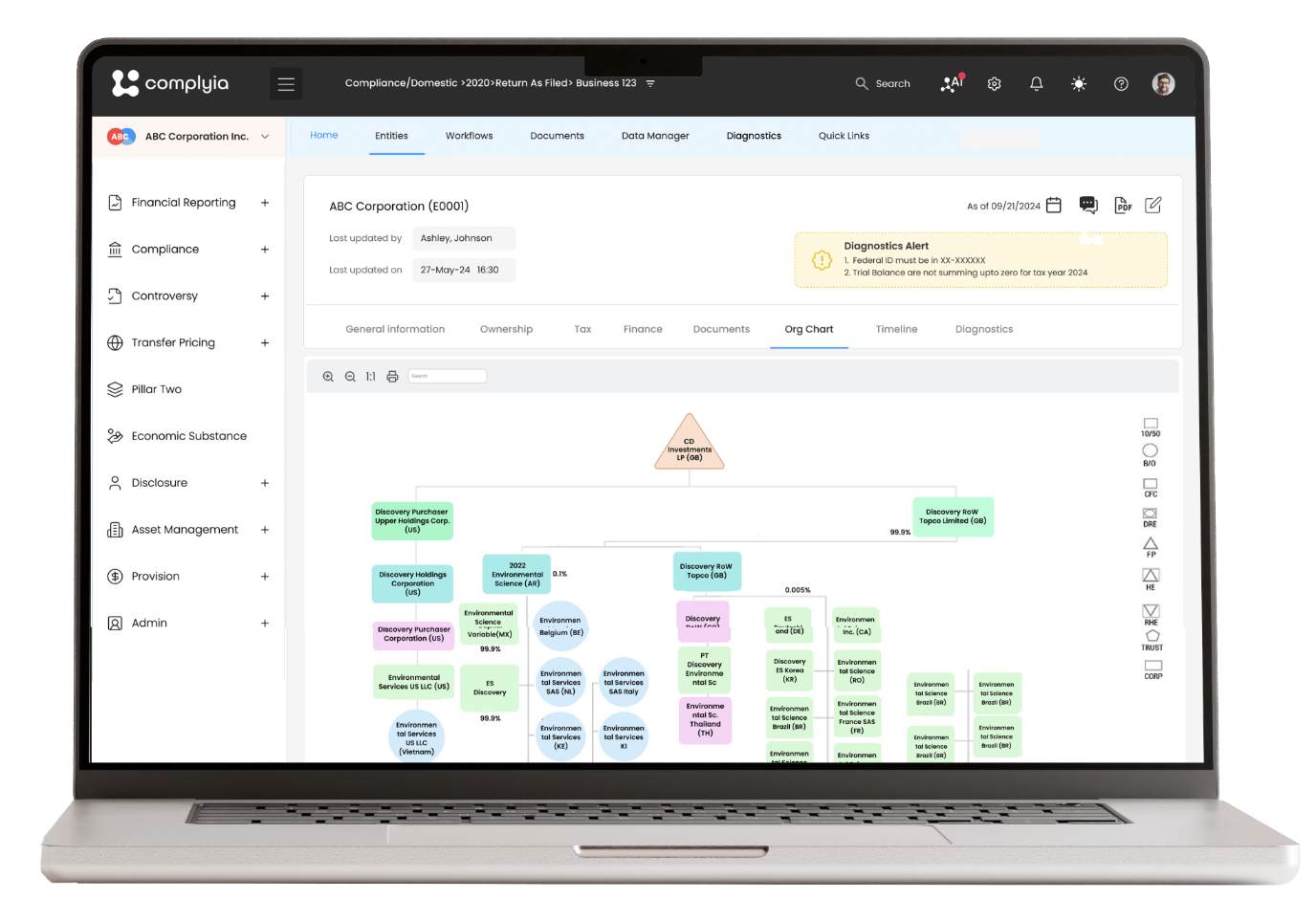

Entity Management: Clarity Starts Here

At the heart of Complyia is its Entity Management module — not just a registry of legal entities, but a dynamic intelligence layer that connects and powers every part of the platform.

This is where Entity Classification happens. Complyia automatically determines which entities are filers, which forms they must file, and the jurisdictional obligations tied to each one. Whether it’s U.S. 1120, foreign filings, partnership returns, Pillar 2 disclosures, or statutory reports — the system classifies filers based on ownership, structure, attributes, activities, and thresholds. No manual lookup. No offline tracking. No spreadsheets.

But Entity Management doesn’t stop at classification — it powers dynamic scenario modeling. Teams can simulate org chart changes — restructurings, mergers, divestitures, entity status changes, or ownership shifts — and instantly see how those changes impact the business.

- Filing obligations

- Provision inputs

- ETR forecasts

- Pillar 2 exposure

- Transfer pricing flows

- Regional compliance calendars

Every “what-if” flows through the system in real time — giving you a risk-free, audit-ready way to plan, pivot, and stay ahead.

Diagnostics / Insights

Diagnostics are the future of compliance, reporting and planning because they turn manual, reactive processes into real-time, intelligent workflows. By automatically identifying risks, anomalies, and gaps as data flows in, diagnostics eliminate time-consuming reviews, improve accuracy, and provide continuous visibility across entities and jurisdictions. They allow teams to shift their time to high-impact work while adapting quickly to regulatory changes.

No more line-by-line, form-by-form manual reviews. Complyia replaces tedious manual work with real-time diagnostics that automatically flag issues, map data, and surface what matters. Instead of spending hours reviewing spreadsheets and forms, your team gets instant insights—so they can focus on resolution, not detection. It’s compliance without the busywork.

| Category | Diagnostic |

|---|---|

| Book-to-Tax | Unmapped Book Accounts |

| ETR | ETR Variance > 5% |

| Deferred Tax | Negative DTA Balances |

| Book-to-Tax | Large Permanent Differences |

| AI Diagnostics | Low AI Confidence in Mapping |

| Estimated Payments | Missed Estimated Payment Deadlines |

| Return to Provision | Provision vs Return Variance > 10% |

| ETR | Entities Missing ETR |

| Deferred Tax | Deferred Not Reversing Within 5 Years |

| Data Quality | Stale Trial Balance Data |

| AI Diagnostics | Inconsistent Mapping Across Entities |

| Book-to-Tax | Temporary Differences Without Expected Reversal |

| Return to Provision | Unrecorded Return-to-Provision Adjustments |

| ETR | YoY ETR Change > 10% |

| Compliance | Entities Missing Tax Calendar |

| Estimated Payments | Estimated Payments Exceed Safe Harbor |

| Data Quality | Manual Entries Without Documentation |

| Book-to-Tax | Recurring BTD Not Applied |

| Deferred Tax | DTL with No Source Asset |

| AI Diagnostics | Entities Flagged for Tax Rate Anomaly (ML) |

| Return to Provision | Provision Adjustments Not Flowing to Compliance |

| ETR | Blended ETR != Consolidated ETR |

| Book-to-Tax | Permanent Difference Not Labeled |

| Data Quality | Missing Source System Tag |

| AI Diagnostics | Anomaly in Provision Adjustment Pattern |